Complete UK HMRC Compliance

FacilityFlow is the only facility management platform with full UK HMRC tax and payroll compliance built-in. Manage your properties AND stay 100% compliant with RTI, Auto Enrolment Pensions, CIS, Making Tax Digital, and statutory reporting.

Why HMRC Compliance Matters for UK Facility Management

Operating facilities in the United Kingdom requires strict adherence to HMRC regulations that affect every aspect of your workforce management. From Real

Time Information (RTI) submissions to Auto Enrolment pensions and Construction Industry Scheme (CIS) compliance, UK tax law has specific requirements that impact facility managers, maintenance technicians, cleaning staff, and contractors.

Non-compliance can result in penalties up to £3,000 per employee, automatic penalty notices for late submissions, and significant reputational damage. HMRC's digital-first approach through Making Tax Digital means manual processes are no longer acceptable.

FacilityFlow's integrated tax and payroll system ensures your facility operations remain compliant with all UK regulations automatically, protecting your business while streamlining operations.

Why HMRC Compliance Matters

Avoid penalties and ensure smooth operations

Compliance Rate

Automated adherence

RTI Deadline

Always on time

Fine Avoided

Per employee penalty

Submission Accuracy

AI-validated payroll & RTI filings

Based on 2024 customer survey of 250+ companies

Built-In UK HMRC Compliance Features

Every requirement of UK tax law and HMRC regulations is automated within FacilityFlow

⚡RTI Submissions & PAYE Reporting

Full automation of Real Time Information (RTI) submissions to HMRC ensures accurate, on-time reporting for every payroll run with zero manual intervention, including automatic FPS submissions on or before payday, EPS for statutory payments, EYU processing for corrections, NVR checks, HMRC-approved XML file generation, Government Gateway integration, automatic PAYE calculations (tax codes and National Insurance), real-time submission status tracking, late submission alerts and prevention, and HMRC acknowledgment processing.

💷 Auto Enrolment & Pension Compliance

Automated compliance with The Pensions Regulator requirements covers employee eligibility assessment, contribution calculations, and pension scheme integration, including automatic monitoring of age and earnings thresholds (£10,000+), postponement period tracking (up to three months), opt-in and opt-out processing, minimum contribution calculations (8% total: 5% employer and 3% employee), pension scheme file generation, automatic re-enrolment every three years, Declaration of Compliance preparation, integration with NEST, NOW:Pensions, and other major providers, and ready-to-use employee communication templates.

🏗️ CIS Deductions & Contractor Management

Complete CIS compliance for facility management companies working with subcontractors is automated through HMRC verification, CIS status checks (registered, gross payment, or standard rate), accurate deduction calculations (20% or 30%), materials versus labor cost allocation, monthly CIS300 return generation, CIS payment and deduction statements (vouchers), year-end CIS annual returns, integration with work order costs, subcontractor payment tracking, and monitoring of HMRC submission deadlines.

💻 Making Tax Digital Integration

Full compliance with HMRC’s Making Tax Digital (MTD) initiative is ensured through MTD-compliant digital record-keeping, secure API integration with HMRC (OAuth 2.0), certified bridging software, quarterly VAT return submissions, fully maintained digital links, automatic penalty prevention, complete audit trails for all submissions, accurate VAT calculation and reconciliation, and readiness for MTD for Income Tax (ITSA) as well as future MTD for Corporation Tax requirements.

📋 Statutory Leave & Payment Calculations

Automated calculation and processing of all UK statutory payments ensures full compliance with current eligibility rules and rates, covering Statutory Sick Pay (SSP), Statutory Maternity Pay (SMP), Statutory Paternity Pay (SPP), Statutory Adoption Pay (SAP), Statutory Shared Parental Pay (ShPP), and Statutory Parental Bereavement Pay (SPBP), alongside automated student loan deductions for Plan 1, Plan 2, Plan 4 (Scotland), and Postgraduate Loans with correct percentage application, threshold monitoring, and automatic updates.

🚗 P11D Reporting & Benefit Taxation

Automated P11D benefit reporting ensures accurate taxation of company cars, fuel benefits, medical insurance, accommodation, loans, childcare benefits, and other taxable perks through CO₂-based car benefit calculations, P11D and P11D(b) generation (PDF and XML), Class 1A National Insurance calculations, timely HMRC submission by the 6 July deadline, and optional payrolling of benefits.

📅 Automated Year-End Returns

Complete automation of UK payroll year-end processing ensures all required submissions to HMRC and employees are handled accurately and on time, including P60 generation by 31 May, final FPS and EPS submissions, P11D and P11D(b) processing for benefits in kind and Class 1A National Insurance, payroll summary reporting, full year-end reconciliation, new tax year setup with updated tax codes, secure archiving of compliance documentation, and automatic PDF distribution to employees.

⚖️ Minimum Wage Compliance Monitoring

Real-time monitoring of National Living Wage (NLW) and National Minimum Wage (NMW) compliance ensures all age bands and apprenticeship levels are correctly paid, covering current 2024/25 rates (£11.44/hr for 21+, £8.60/hr for 18–20, £6.40/hr for 16–17 and apprentices under 19 or in their first year), automatic updates with government changes, hours worked verification excluding breaks, salary sacrifice impact calculations, accommodation offset limits, underpayment compliance alerts, and HMRC audit-ready documentation.

The Numbers Speak for Themselves

Real results from real customers

Avoided

Annually in HMRC penalties and fines

Hours Saved

Per year in manual payroll and RTI processing

On-Time

RTI submissions (24-hour deadline always met)

Penalty Notices

Since switching to automated compliance

Minutes

Average time for monthly CIS return vs. 4 hours manual

Saved

Annual cost of separate payroll software eliminated

Based on 2024 customer survey of 250+ companies

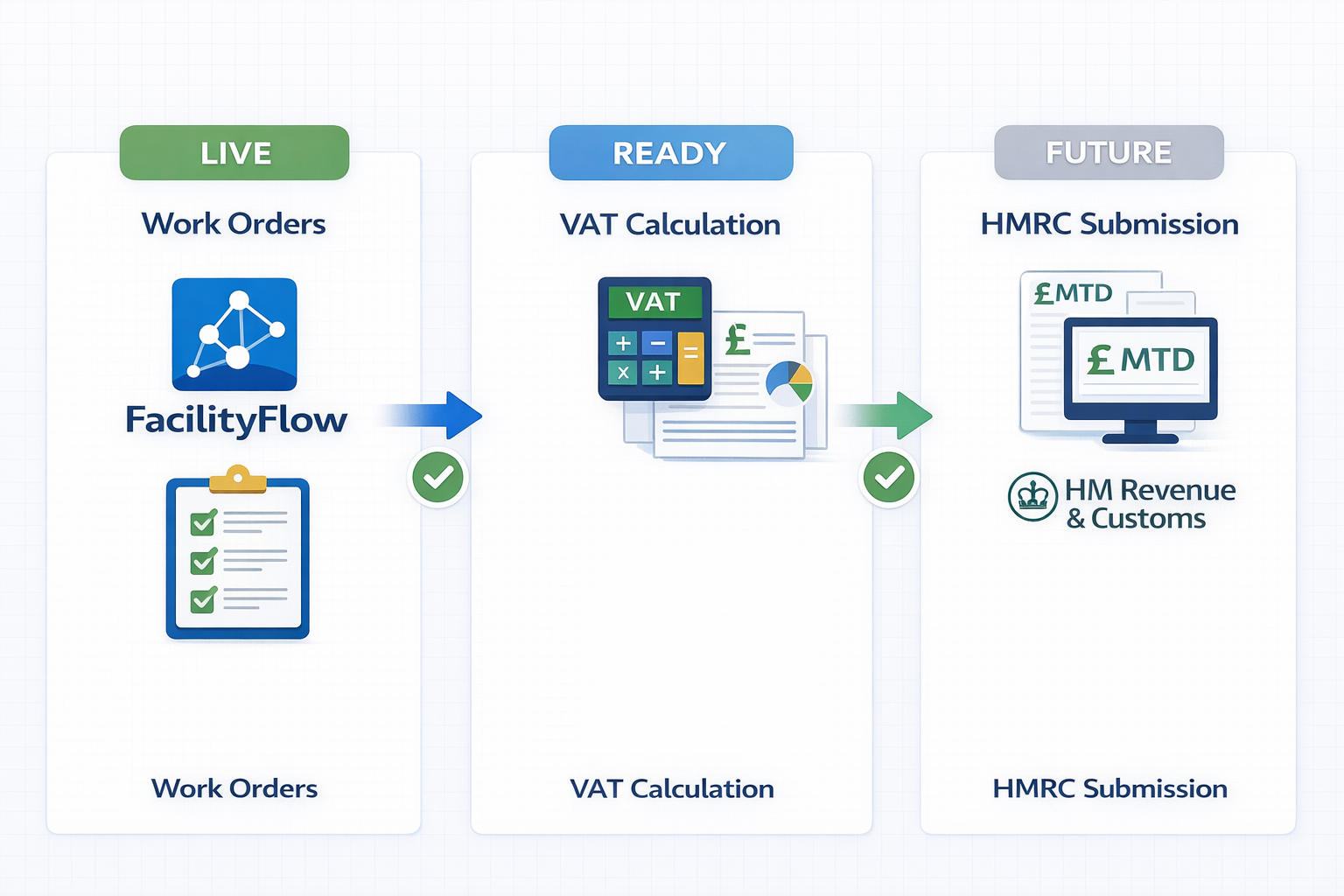

Making Tax Digital Ready for All HMRC Initiatives

FacilityFlow is fully compliant with current and upcoming Making Tax Digital requirements, ensuring your facility operations are future-proofed for HMRC's digital transformation.

✓ MTD for VAT

API integration with HMRC (OAuth 2.0) enables digital VAT return submission, quarterly VAT calculations, reconciliation reports, MTD-compliant digital record-keeping, audit trail maintenance, certified bridging software use, automatic penalty prevention, and compliance with the mandatory requirement for VAT-registered businesses with £85,000+ turnover.

🔜 MTD for Income Tax Self Assessment

Quarterly update submissions, end-of-period statement preparation, final declaration support, income and expenses tracking, certified digital links, self-employed and partnership support, and property income reporting, applicable to sole traders with income of £50,000 or more.

🏢 MTD for Corporation Tax

Future-ready architecture supporting corporation tax tracking, iXBRL tagging, digital accounts preparation, CT600 digital submission readiness, Companies House integration, expected implementation from April 2026 onward, with FacilityFlow updates completed before the mandate.

MTD Benefits for Facility Managers

Why MTD Integration Matters:

Traditional Approach:

- Export data from FM system

- Import into separate accounting software

- Manual reconciliation (error-prone)

- Duplicate data entry

- Missing audit trail

- Late submission risks

FacilityFlow Integrated Approach:

- Work orders generate financial transactions automatically

- VAT calculated in real-time on service jobs

- CIS deductions integrated with MTD submissions

- One-click quarterly VAT returns

- Complete digital audit trail from work order → tax submission

- Automatic deadline reminders

- Zero risk of late filing penalties

Automated UK Compliance: From Hire to Tax Return

FacilityFlow manages UK tax and payroll compliance throughout the employee lifecycle

👤➕ HMRC-Compliant Hiring

When hiring UK facility staff, processes include capturing P45 details from previous employers, completing Starter Declarations (A, B, or C), assigning and validating tax codes, verifying National Insurance numbers, assessing auto-enrolment eligibility, applying emergency tax codes if needed (1257L), identifying student loan plans, verifying right to work, documenting contracts and terms, and submitting new starter information to HMRC via RTI.

📱⚙️ Real-Time Work & Pay Integration

During facility operations, processes include time tracking from work orders to payroll, overtime calculation in line with Working Time Regulations, company vehicle usage linked to P11D reporting, tool and equipment provision assessed as benefits, uniform and PPE monitoring (non-taxable if job-essential), mobile attendance with GPS verification, break time compliance (minimum rest periods), night shift and weekend premium pay, and subcontractor CIS work tracking.

💷📊 Automated Payroll & RTI

Every pay period (weekly, fortnightly, or monthly), processes include PAYE tax calculation based on tax code, National Insurance deductions for employee and employer, student loan deductions (Plans 1, 2, 4, and Postgraduate), auto-enrolment pension contributions, statutory payments (SSP, SMP, SPP, etc.), court orders via attachment of earnings, net pay calculation, digital or printed payslip generation, RTI FPS submission to HMRC on or before payday, bank payment file creation (BACS), and pension scheme file upload.

📄✓ Ongoing Regulatory Reporting

Automatic monthly and quarterly tasks include CIS monthly returns (if applicable) by the 19th, Employer Payment Summary (EPS) for statutory recoveries, quarterly VAT return submissions (MTD-compliant), auto-enrolment re-declaration every three years, minimum wage compliance checks, gender pay gap reporting for organizations with 250+ employees, payroll reconciliation and review, HMRC payment preparation, pension scheme contribution payments, and monitoring of HMRC acknowledgments.

📅✓ Tax Year-End Returns

At UK tax year-end (April 5), tasks include final FPS submission for the year, P60 generation by May 31, P11D submission for benefits in kind by July 6, P11D(b) Class 1A National Insurance calculation and payment, year-end payroll reconciliation, CIS annual return, archiving compliance records for six years, new tax year setup with updated tax codes, auto-enrolment re-enrolment if due, and payroll summary reports for directors.

UK Compliance Across All Property & Facility Types

Whether you manage commercial properties, NHS facilities, schools, or industrial sites, FacilityFlow ensures complete UK tax and employment compliance.

🏢 Office Buildings & Business Parks

Property management staff payroll, security and cleaning team compliance, CIS subcontractor management for maintenance, multi-site consolidated payroll, benefit-in-kind tracking (company cars), part-time and zero-hours contract handling, agency worker management, and service charge cost allocation.

🏥 Hospitals & Medical Facilities

Shift-based payroll for estates teams, NHS pension scheme integration, unsocial hours payments, bank and agency staff management, on-call allowances and overtime, 7-day working compliance, AfC (Agenda for Change) pay scales, and statutory sick pay management.

🎓 Schools, Colleges & Universities

Term-time and holiday working pattern management, teachers’ pension scheme integration, support staff and caretaker payroll, casual and temporary staff management, auto-enrolment for non-teaching staff, school holiday pay calculations, facility manager contracted hours tracking, and student employment compliance.

🏭 Factories & Warehouses

Multi-shift pattern management, night shift and weekend premium calculation, overtime calculation with limits, compliance with Working Time Regulations, zero-hours and flexible worker management, statutory holiday accrual, CIS management for facility contractors, and health and safety training tracking.

FacilityFlow vs. Separate Systems: UK Compliance Comparison

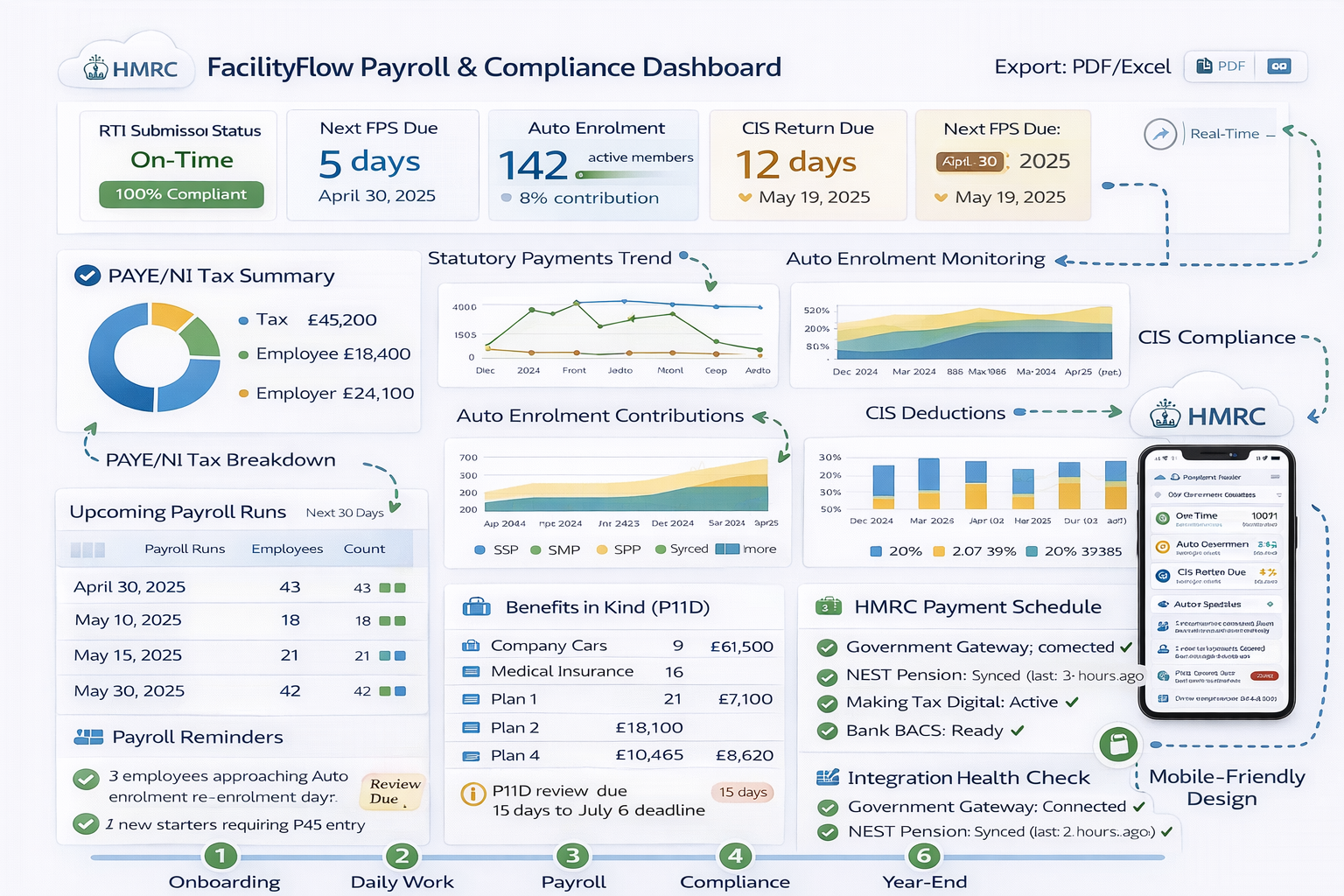

Real-Time UK Compliance Dashboard

Monitor all HMRC compliance metrics from one unified dashboard

Comprehensive UK Compliance Support

📚 Compliance Resources

UK HMRC compliance handbook, RTI submission step-by-step guide, auto-enrolment implementation checklist, CIS contractor management guide, Making Tax Digital setup instructions, year-end processing calendar, P11D benefit reporting templates, monthly compliance task checklist, automated HMRC deadline calendar, and regulatory update notifications.

🎓 Team Training

Payroll administrator training, facility manager compliance overview, RTI and FPS submission workshops, auto-enrolment compliance certification, CIS for facility managers course, Making Tax Digital webinars, year-end processing bootcamp, quarterly regulatory update sessions, UK-wide on-site training, and CPD-accredited courses.

🤝 UK Compliance Team

UK-based payroll compliance specialists, HMRC regulation experts, auto-enrolment pension specialists, CIS and construction tax advisors, MTD implementation support, monthly compliance review calls, HMRC enquiry assistance, year-end deadline support, 24/7 emergency payroll hotline, and dedicated account manager for enterprise clients.

Frequently Asked Questions: UK HMRC Compliance

Ready to Ensure UK HMRC Compliance for Your Facilities?

Join UK facility managers who trust FacilityFlow for complete tax and payroll compliance.